Greetings National Indoor RV Centers family of customers and friends.

I know many of you were expecting my next video to be part two of my musings on why the motorhome market has been in decline for the past 40 years. However, coming off of three rallies and three shows, all back-to-back, overwhelming, the two questions I was repeatedly asked were:

- What does the motorhome market look like today post-COVID?

- When will be a good time to buy a motorhome?

I promise I’ll finish the two videos on why motorhome sales have been declining for four decades, and what needs to happen to correct the trend. However, at the moment, what seems to be of the most interest to motorhome owners is the current state of the market. So, I’m calling an audible and will share my thoughts on the current state of the motorhome market, and what the next year or two may look like.

If you’ve watched any of my prior videos, it should be abundantly clear videos are not my expertise. I am very uncomfortable during their filming, and reluctant to make them. Videos are not second nature to me like they are for Angie. And, as I have said before, we are masters of what we silence and slave to what we say. Hence, if you are watching this video, just know I am in my stress zone!

If you like data, and if numbers speak to you, then this video should be right up your alley. Otherwise, it will just be another antidote for your insomnia.

Speaking of uncomfortable, I have never been comfortable with making predictions or projections! Yet, in business, we must make them both. They are simply necessary evils. And, now is probably a good time to discuss the difference between a prediction and a projection.

A prediction is to prophesy or foretell what is likely to happen in the future, whereas a projection is the exercise of calculating a numerical value associated with a future event. I think of predictions as changes in direction, like market tops or bottoms, whereas I view projections to be more like a pro forma or a budget. To make the distinction between a prediction and a projection more clear, let’s look at a couple of examples of predictions.

Some predictions are clear and much easier to make, like this directional prediction from a video we published on 4/24/2020 just as our nation was shutting down due to the Pandemic.

In another video we published on 6/30/21 I shared some of the data I was relying on in April of 2020 when I felt the RV industry was going to see a boom.

Here is an interesting statistic to close the loop on TSA security checks. On 4/23/23 TSA security checks were 2,570,184, or 48,787 more passengers than the pre-pandemic 2,521,397 recorded on 4/23/19. Boy, that was quite the four-year ride for the airline industry!

Here is a second example of a prediction that wasn’t directional in nature, but rather spotting a market dislocation or imperfection, like this statement from our 6/30/21 video:

For almost two years used motorhomes increased in value by 22%, when they should have depreciated by 24 to 30% during those same two years. And, they didn’t just appreciate in value, their premium to Book Value also went up by 50%! By the peak of the market used motorhomes were overvalued by 52%! During this same period of time the price of new coaches had only increased by 4%. That dislocation between new and used motorhome prices provided an opportunity we had never seen before for those of us who already owned a motorhome to upgrade to a new motorhome for little to no cost. And, at record-low interest rates! Who wouldn’t make that trade?! Unfortunately, also implicit in my message was the fact there had never been a worse time in the history of the RV industry to have purchased a used motorhome.

Now, let’s talk about projections. What do we think the market is going to look like over the next couple of years? Before we jump to figuring it out, I would like to make a few disclosures.

First, the truth of the matter is, that we do spend an incredible amount of time on projections every year here at National Indoor RV Centers. And the projection we spend the most time on each year is… what will be the size of the motorhome market in the coming year? If we are wrong in projecting the size of the motorhome market by more than 5%, the compounded ripple effect throughout our P&L could be devastating. If we are wrong about the size of the motorhome market, we will also be wrong about how many Class A, Class B, and Class C motorhomes will be sold. Consequently, when we apply National Indoor RV Center’s market share to each class, we will be wrong in how many motorhomes we will sell. Which in turn means our budget will be wrong from the top line all the way down to our bottom line. Our headcount, capacity, and utilization of our capacity will all be wrong as well, which means our breakeven point will also be wrong. And, if we are wrong on our breakeven point by 10% the wrong way, we will have no net income. And, we don’t get the luxury of revising our projection and budget every quarter. Just like Julius Caesar so famously stated after crossing the Rubicon, “The die is cast!” The same is true for our annual projection and budget. Once published, for better or for worse, we have to live and die by our projections and our budget for the rest of the year. Consequently, we spend a lot of time and focus on what we believe the size of the motorhome market will be each year, and we don’t simply rely on other industry authorities or experts, because those folks don’t know our business as intimately as we know our own business. Nor will it cost them a dime if their projections are wildly wrong. They have no vested interest in our business.

Second, I do believe every projection is wrong the second it is made. With that said, our projection MUST be correct directionally, and we MUST be within the ballpark. What do we consider being in the ballpark to be? As I mentioned a moment ago, I believe we MUST be within 5%.

Third, I do realize many who will watch this video will mistakenly discount it as just another RV dealer trying to sell motorhomes. I’ll do my best to make certain that isn’t the case. As a company, we have always strived to follow John Wooden’s advice of being more concerned with our character than our reputation, because our character is what we are, while our reputation is merely what others think we are. So, I’m going to pull back the curtain and walk you through the exact data set, assumptions, and process we used for creating our 2023 and 2024 market projections for our budgets. In other words, our money is where our mouth is. Literally! We are truly eating our own cooking with our projections.

And lastly, I would like to quote Warren Buffett:

“We are living in a time where intelligent people are being silenced so that stupid people won’t be offended.”

Unlike Angie’s videos, I do receive quite a bit of hate mail after each of my videos. I want you to know this is not my intent. I sincerely hope no one will feel offended by this video. Rather, I truly hope you will feel this was a worthwhile and intelligent exercise, and hopefully you will learn something from my observations.

With those disclosures out of the way, let’s move on to how we build our projections each year here at National Indoor RV Centers. We start our budget process every September by projecting what we think the size of the motorhome market will be for the upcoming year. And, I would like to take you back to September of 2022 when we built our 2023 projection because you will see later on how our 2023 projection served as the foundation for our 2024 projection.

Of course, we always start each year’s budget process by looking at what the industry’s authority, the RV Industry Association, or the RVIA for short, is projecting. In September of 2022, the RVIA projected the motorhome market would drop 7.8% from 53,700 units shipped at the end of 2022 to a bottom of 49,500 units by the end of the second quarter of 2023 but finish the full year at 50,000 total motorhome units. The RVIA projected the motorhome market would decline 6.9% in 2023 stating:

“RV shipments will move along the back side of the business cycle (Phase C, Slowing Growth, followed by Phase D, Contraction) into the middle of next year. Expect Phase A, Recovery, to characterize the second half of 2023.”

The RVIA sited they used U.S. Domestic Product, ITR Retail Sales Leading Indicator, U.S. Light Retail Sales, U.S. Disposable Income, U.S. Single-Unit Housing Starts, and U.S. Total Retail Sales as their “Relevant RV Industry Indicators.”

I will admit, the RVIA’s projection of 50,000 shipments of motorhomes for 2023 didn’t inspire much confidence in terms of probability for me, and certainly not enough confidence to anchor National Indoor RV Center’s 2023 budget to their projection, for two reasons:

- We were coming off a bull market which had just seen a 43.1% increase in the shipment of motorhomes. For the RVIA’s projected decline of 6.9% to come to fruition, it would have meant both the shortest and shallowest decline in the history of the industry would need to occur.

- We found no significant statistical correlation between their 6 “Relevant RV Industry Indicators” and motorhome sales. In other words, no predictive value when projecting market demand.

Now, if I may, I would like to pull back the curtain and walk you through in detail how we built our 2023 projection. So, let’s start by seeing what we can glean from history. Then, I will juxtapose what history tells us with current market conditions.

As a point of clarification, we have always used history, because of its predictive value, the 30-Year Treasury Bond, the S&P 500, the U.S. Median Household Income, and the 35-foot Tiffin Allegro Diesel motorhome as our “Relevant RV Industry Indicators,” because we have never found any other indicators with higher correlations. Remembering back to our high school statistics class, a correlation of 0.7 or greater, is considered a strong correlation. We found the 30-year Treasury Bond to correlate best to the standard 20-year retail motorhome finance rates, with a negative correlation of -0.75. The strong negative correlation to motorhome sales simply means when interest rates go up, motorhome sales go down.

The U.S. Median Household Income is highly correlated at 0.86 to purchasers who finance their purchase of a motorhome. And, the S&P 500 is also highly correlated at 0.83 to purchasers who pay cash when purchasing a motorhome. Lastly, we use the Tiffin 35’ Allegro Diesel motorhome expressed as a multiple of both the S&P 500 and the U.S. Median Household Income. The reason we use the Tiffin 35’ Allegro Diesel motorhome is because it’s the only motorhome that was in production in 1980, and is still in production today.

As Mark Twain once said: “History doesn’t repeat itself, but it often rhymes.” Looking in the rear-view mirror at the past 44 years of the motorhome industry, we asked ourselves if the industry had ever seen economic and market conditions similar to what we found ourselves in back in September of 2022. Or, more precisely, when adjusted for inflation, had we ever seen the 30-Year Treasury Bond, the S&P 500, and the U.S. Median Household Income as it relates to the Tiffin 35-foot Allegro Diesel motorhome akin to what we were seeing in September of 2022? And, the answer was yes! We found the years 1988 through 1991 to certainly “rhyme” with what we were seeing in September of 2022.

I would first like to take a look at interest rates in September of 1987, 35 years to the month prior to when we were making our 2023 projections in September of 2022. From September of 1987 to the end of the year 1988 the Fed raised the Fed Funds Rate from 7.25% to 8.75%. For that economic cycle, the Fed stopped increasing the Fed Funds rate at 9.75% in February of 1989. That was a 34.5% increase in the Fed Funds rate from September 1987 to its peak of 9.75% in February 1989. In terms of the real Fed Funds rate, the rate after inflation, the real Fed Funds rate in 1987 was a positive 3.6%, and by the end of 1988, it was 4.61%. After February of 1989, the Fed consistently cut the Fed Funds rate reaching its low for the economic cycle at 3.0% in September of 1992.

In September of 2022, at the time we were developing our 2023 projection, the Fed Funds rate stood at 3.25%, and the real rate, the rate after inflation, was a negative -5.05%. Clearly, money was too cheap, or inflation was too high, or a combination of both. Regardless, sooner or later they would need to come back into line.

However, when we looked to the Swaptions Market to see what investors had priced into the market we saw the market had priced in the probability of 5.276 one-quarter point interest rate increases by the end of 2023, for an implied Fed Funds rate of 4.412%. To be clear, the Swaption’s Market was pricing in the Fed Funds going from 3.25% to 4.412%, or a 35.7% increase over the coming 15 months. I think we can all agree the 35.7% increase in the Fed Funds rate the Swaptions Market was implying for 2023 certainly “rhymed” with the 34.5% rate increase for the same period of time back in 1987.

So, what actually happened to the Fed Funds rate in 2023? As it turns out, from September 21st, 2022 to the end of the year 2023 the Fed raised the Fed Funds rate 6 times to 5.5%. Basically, the Fed had one more rate increase than what the market had priced in back in September of 2022, and the Fed Funds rate ended up 1.09% higher than what the market had priced in. However, the real interest rate was now a positive 2.1%. Here at National Indoor RV Centers, we use the Fed Funds rate to help us project and budget our flooring interest costs, and we didn’t feel a negative real Fed Funds rate was sustainable. So, we did project and budget our flooring interest expense assuming the real rate for Fed Funds would return to its long-term average of 2.5%, which translated to a 6% Fed Funds rate by the end of 2023. Thankfully, we were a 1/2% higher than what the Fed Funds rate turned out to be.

Now, let’s take a look at the 30-year treasury bond since it correlates closely to the retail finance rates for motorhomes. And, those retail finance rates certainly do impact motorhome sales!

In 1987 the 30-year treasury bond yielded 9%, and the real return after inflation was 5.35%. By the end of 1988, the 30-year treasury bond yielded 7.98%, and the real return was 3.84%. Much closer to its long-term average real rate of 3.63%.

Now, let’s look at what we were seeing 35 years later in September of 2022. The 30-year treasury was yielding 3.61%, and its real return was a negative -4.69%. That was absurdly cheap money, and especially for 30 years! Clearly, unsustainable!

When we looked to see what the futures market was pricing in for the 30-treasury bond by the end of 2023 we were surprised. The futures market was pricing in a 10-basis point, or 1/10 of a percent lower yield at 3.51% by the end of 2023. Given where inflation was at the time, we felt strongly at National Indoor RV Centers the yield on the 30-year treasury bond was destined to go up, and not down as the futures market was suggesting. Just like in the case of the Fed Funds rate going up 34.5% from September 1987 to December 1988, we felt we should assume the same for the 30-year treasury bond, so used a yield of 4.85% in our modeling and budgeting.

Again, what happened to the yield on the 30-year treasury bond by the end of 2023? How accurate was the futures market? How accurate were we? Well, the yield on the 30-year treasury stood at 4.03% on 12/29/23, and its real yield after inflation was finally positive. Albeit at a measly yield of just 63 basis points, which was still a full 3.0% below its long-term average real yield of 3.63%. At 3.51% the futures market ended up being too low by 12.9%, and at 4.85% National Indoor RV Centers ended up being too high by 20.3%. In percentage terms, the futures market was closer to the mark than we were. All I have to say about that is… I would rather sleep well than eat well.

My last comment on rates before we move on is this. In terms of real interest rates, meaning after inflation, you can’t have cheap money in both short-term and long-term interest rates without inflation. Think of it this way. You can’t incentivize borrowing and de-incentivize savings to that degree across the yield curve without inflationary consequences.

Now, going back to our 44-year history we can see there have been 6 completed cycles. Or, put another way, 6 downturns followed by 6 recoveries. We are currently in our 7th downturn, and way away from a recovery starting. So, I’m guessing that statement will prompt two questions:

- When will we hit the bottom of this current cycle?

- And, where will the bottom be in terms of new motorhome sales?

When we look back at the 6 completed cycles, we can see the average length of time from the peak of each cycle to the bottom of each cycle was 2.833 years, or 34 months. We can also see motorhomes reached their peak in 2022 at 58,403. More specifically, March of 2022 is when motorhomes reached their high-water mark for this cycle. So, with these data points let’s see how history might rhyme.

We can see from history that from the 1988 peak all the way down to the bottom in1991, the decline was 43.1%. And, it was the second-largest drop in the industry’s history. The largest drop in the industry’s history was during 2008 and 2009 at 81.5%. However, I believe 2008 and 2009 to have been a Black Swan event, and it certainly wasn’t going to be repeated during this cycle. We also felt the drop from peak to the trough was probably going to be slightly greater than the 43.1% in 1987 for two reasons:

One, we were coming off a bull market which had just coincidentally experienced a 43.1% increase. Yet another rhyme with history.

And two, real interest rates, the rate after inflation, were significantly higher in 1987 and 1988 than they were in 2022, and what they were forecasted to be in 2023.

When you look at this chart of the Fed Funds rate and the yield on the 30-year treasury bond, you can see how ridiculously low real interest rates were in 2023 when compared to 1988. Real interest rates were going to need to increase some more, which wouldn’t help motorhome sales.

All things considered, we felt the drop for this cycle would be slightly more than the drop in 1988 of 43.1%, so we landed on a drop of 45%. Or, put another way, we felt the drop from peak to trough this cycle would be 4.4% greater than the cycle that began in 1988. Which meant the bottom of this current cycle should be in the neighborhood of 32,122 motorhome sales. And, as I previously mentioned, the market peaked in March of 2022, and the average peak to trough for the previous 6 cycles was 34 months, so we felt in September of 2022 the bottom would occur around February of 2025. However, we also knew we would get another “look-see” at current market conditions at the end of 2023 and adjust our timing of when the market would bottom in our 2024 projection. Which we will do here in a minute. Therefore, we used the average of 34 months, or February 2025, to help us project the trajectory or the slope of the decline for our 2023 projection.

I would like to point out we didn’t use a 34-month linear decline from March of 2022 to February of 2025. Those dates were merely our beginning and ending points. As to the trajectory, or the slope of the decline over those 34 months, we determined it based solely on my prior 44 years of experience across several market cycles in equities, fixed income, and real estate. Bottom line, a good rule of thumb for me has always been that 2/3 of the total decline between the peak and the trough will occur during the first 50% of the drop, and the remaining 1/3 will occur during the final 50% of the drop. Using the peak in March of 2022 as our beginning point, this math indicated there would be 39,218 motorhomes sold during 2023. And of course, we knew we would get to take another look at the market at the end of 2023 and adjust our trajectory as necessary.

As I previously mentioned, our 2023 projection would become the foundation for our 2024 projection. This means we need to see how our 2023 projection stood up to the market’s actual performance, so we could make any necessary adjustments to our 2024 projection.

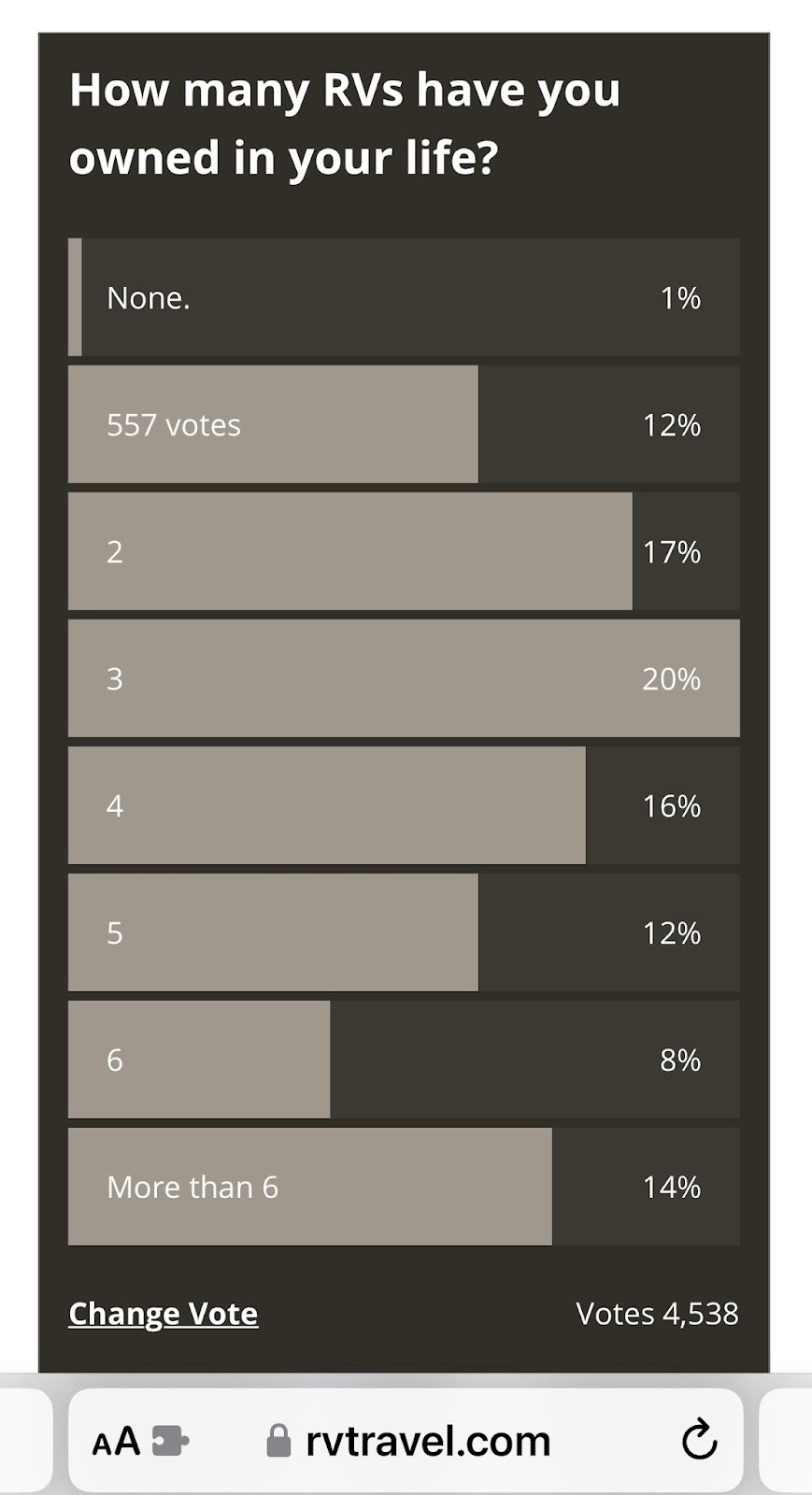

As you can see from this chart, Statistical Surveys Inc. reported total motorhome retail sales of 39,737 for 2023. This was 519 more motorhomes sold than the 39,218 we had projected. Basically, our projection for 2023 missed the market’s actual performance by 1.3%. Yes, we were both pleased and a bit lucky with our 2023 projection. Fortunately, it was another year we were within our tolerance of 5%, and more importantly, our miss was on the low side, and thankfully not on the high side.

Hopefully, you can now see how our 2023 projection made our 2024 projection so much easier to make. Our 2023 projection confirmed we had picked the right cycle in history to project off of, 1988 through 1991. Plus, it confirmed our trajectory of the drop from the peak in March of 2022 through December of 2023 was also correct. From there, it was just a simple math equation. Motorhome sales will need to drop another 19.1% to get down to the trough we are projecting of 32,122.

As we do every September, let’s see what the RVIA was projecting for 2024. And, as I mentioned earlier, let’s now also look at current market conditions to see if we need to tweak our trajectory in our 2024 Projection.

For 2024 the RVIA was projecting total shipments of 52,900 motorhomes, or a 15.3% increase over 2023’s actual shipments of 45,879. Once again, the RVIA’s projection of a 15.3% increase in 2024 didn’t inspire much confidence in terms of probability. Especially, when history during very similar economic conditions was pointing towards a 19.1% decline in 2024. For what it is worth, Statistical Surveys, Inc. just released their January 2024 retail motorhome sales, and year over year, motorhome sales were down 17.8% in January 2024. That is 6.8% better than what National Indoor RV Centers projected when we created our 2024 projection. However, there are still 11 months to go, and I’m clearly betting we will end 2024 within 5% of our projection. And whatever we do miss it by, it better be because we projected a bit too low.

Let’s take a minute and stress test the RVIA’s assumptions a little bit. And, let’s also see what the current supply of motorhomes sitting on dealer’s lots looks like. This will also let us know if we are still on target to reach the trough of this cycle somewhere between the end of 2024 and February 2025 as history would suggest.

The first column of this chart shows dealer inventory by Class at the end of 2023.

The second column shows the RVIA’s projected shipments from manufacturers to dealers by Class.

The third column reflects what the total 2024 supply of motorhomes will be if manufacturers continue to build and ship in line with the RVIA’s projections.

The fourth column reflects National Indoor RV Center’s projected 2024 motorhome sales, or demand if you will.

The fifth column reflects what dealer inventory will be at the end of 2024 if manufacturers build and ship in line with RVIA’s projections, and if National Indoor RV Center’s projection of motorhomes sales is in the ballpark.

The last column reflects how many months’ supply of motorhomes dealers will end the year 2024 with. Now, I’m sure everyone has an opinion of what they believe an adequate, or healthy level of inventory is. But I think we can all agree it is not 15.7 months’ worth. That is 1.3 years’ worth of inventory!

When it comes to the supply and demand of motorhomes, I liken it to produce at the grocery store. Just because manufacturers decide to increase their production of produce, and grocers are willing to go along and stock more produce, doesn’t mean they’ve generated any additional demand. The produce will just sit there and rot on the grocer’s shelves. The only difference is motorhomes have a little longer shelf life than produce. The shelf life of a new motorhome is one year, after that NADA publishes a Book Value every 60 days, which declines between 2% and 2.5% with each change in Book Value.

Reasonable minds can, and do disagree, on what is a reasonable supply of motorhome inventory, as expressed in months’ supply. Let’s see if we can bring some perspective to what a reasonable amount of inventory for a motorhome dealer is.

According to Automotive News, the big 6 publicly traded auto dealers ended the fourth quarter of 2023 with 36 days’ supply or 1.2 months of new vehicle inventory.

If you look at inventory turns by economic sector, you can see Consumer Discretionary, which is the sector motorhomes fall into, is 6.86 inventory turns per year. Or, 1.75 months’ supply in inventory.

And lastly, when it comes to housing the National Association of Realtors says a 6-month supply of homes for sale is a balanced market. They consider anything less than 6 months to be a seller’s market, and anything over 6 months to be a buyer’s market. I would like to point out that while a lot of motorhomes cost as much as a house, I don’t believe houses are a good comparison for dealer inventory for two reasons:

First, homes appreciate, and motorhomes depreciate just like produce.

Second, regardless of the industry, 6 months of inventory equals two inventory turns per year, which makes it very difficult for any retailer to be profitable. In fact, home builders who carry an average 6 months of inventory go out of business.

However, while I don’t agree with the comparison, I am still going to use the housing market for purposes of stress testing our 2024 projection.

Going back to our chart we can see that given current dealer inventories, RVIA’s projected motorhome shipments, our projected 2024 motorhome sales, and assuming the housing market’s inventory levels, in the motorhome market’s best-case scenario, we will not reach the bottom of this cycle until October of 2025. If we split the difference between autos and housing, we won’t reach the bottom until January of 2026. January of 2026 would result in a peak-to-trough for this cycle of 46 months. Again, 46 months sure does “rhyme” with the 47-month peak to trough of 1988 through 1991.

Two things will need to happen for the bottom of this cycle to occur by the end of 2024, and they are lower production coupled with more demand. More demand would require a significant increase in the stock market, and or, lower interest rates. How probable is any one of these three things to occur? Well, let’s look.

The long-term earnings yield of the S&P 500 is 4.29%, or in other words, a price-to-earnings ratio of 23.3. The current earnings yield of the S&P 500 as of 3/7/2024 is 3.51%, or a price-to-earnings ratio of 28.5. Also, the Volatility Index, or the VIX for short, is a measure of market volatility and is often used as a confirming indicator of relative value for the stock market. The VIX closed at 14.22 on 3/7/2024. As the saying regarding the VIX goes… when it’s high you buy, and when it’s low you go! Readings above 30 are considered high, and signal a good time to buy, and readings below 20 are considered low, and signal a good time to sell. Based on the current earnings yield of the S&P 500, coupled with the VIX, the stock market looks frothy to me. I don’t see the stock market creating any additional demand for motorhome sales during 2024.

When we look at the real returns of the 30-year treasury bond at 63 basis points versus its long-term average real return of 3.63%, I also don’t see lower interest rates in 2024 creating more demand for motorhomes.

So, that leaves us with what is the likelihood of manufacturers cutting their production even further in 2024? As you look at this chart reflecting a 15.7 month supply of motorhomes on dealer’s lots at the end of 2024, and we use the absurd assumption of 6 months in dealer inventory as being healthy, how much would manufacturers need to cut their production in 2024? Well, the math is simple. They would need to end the year with 16,061 motorhomes in dealer inventory, and not the 41,911 motorhomes the RVIA’s projection of motorhome shipments would produce. So, 41,911 minus 16,061 means manufacturers would need to cut their production by 25,850 motorhomes, and only produce 27,050 motorhomes during 2024. The industry hasn’t produced so few motorhomes since 2011, so I don’t find this to be a very probable scenario either. Personally, I don’t believe they can cut their production by that much and still maintain a workforce.

This has been a long video just to get to what all this means for those of you who might be considering the purchase of a new motorhome. What are the four key takeaways from this video?

The first takeaway would be, that the motorhome market is clearly overbuilt across all classes, which means this is a buyer’s market.

Secondly, with stocks, we all know the very bottom of the market is the best buying opportunity. However, that is not the case with motorhomes. The very bottom of the market in terms of motorhome sales is when supply and demand have reached equilibrium, and prices have started to increase. With motorhomes, the very best time to buy is when the market is the most overbuilt.

Thirdly, the motorhome market hasn’t been this overbuilt in well over a decade. I did state in 2021 I had never seen a better time in my lifetime to buy a new motorhome if you already owned a motorhome. That market dislocation occurred because of an extreme seller’s market. Existing coaches were way overvalued! This time I’m saying there will not be a better time to purchase a new motorhome until we reach this point again in the next cycle 6 or 7 years from now. And I don’t believe the market will get this overbuilt in the next cycle. The confluence of events that led up to the current level of overbuilding was truly unique.

And fourth, there is no more blood to give. The entire supply chain is losing money. The component suppliers are losing money. The manufacturers are losing money. The dealers are losing money. And not just a little money! For example, one of our country’s largest dealers announced their fourth-quarter earnings this morning. To give their earnings some perspective, they ended their 3rd quarter of 2023 with $265,840,000 of shareholder equity, and they just reported a fourth-quarter pre-tax loss of $137,685,000! Their pre-tax loss equaled 48% of their shareholder’s equity! My point is this, should you happen to be a buyer, you can rest assured there is no margin left in motorhomes for anyone in the supply chain.

This is a buyer’s market, the likes of which I haven’t seen since becoming a dealer. The Great Recession of 2008 and 2009 was the only buyer’s market better than this buyer’s market. But, as I said earlier in this video, I truly believe the Great Recession of 2008 and 2009 to have been a Black Swan event.

It’s said, “Life’s biggest tragedy is we get old too soon, and wise too late.” When I think back over all the memories our family has shared since purchasing our first motorhome in 1985, I was very blessed to have grown wise too soon, and old too late in this regard.

I wish you all safe travels, and only the best. And thank you for your time.